Irs Guidelines For Reimbursable Expenses

Reimbursement policy employee expense sample template business pdf How to reimburse expenses Expenses taxable reimbursement gabotaf reimbursable

PPT - Accounts Payable PowerPoint Presentation - ID:20533

Reimbursable rates (pdf) Expenses reimbursement procedures policies ppt powerpoint presentation general travel Irs gives tips on filing, paying electronically and checking refunds

Eligible reimbursable expenses list

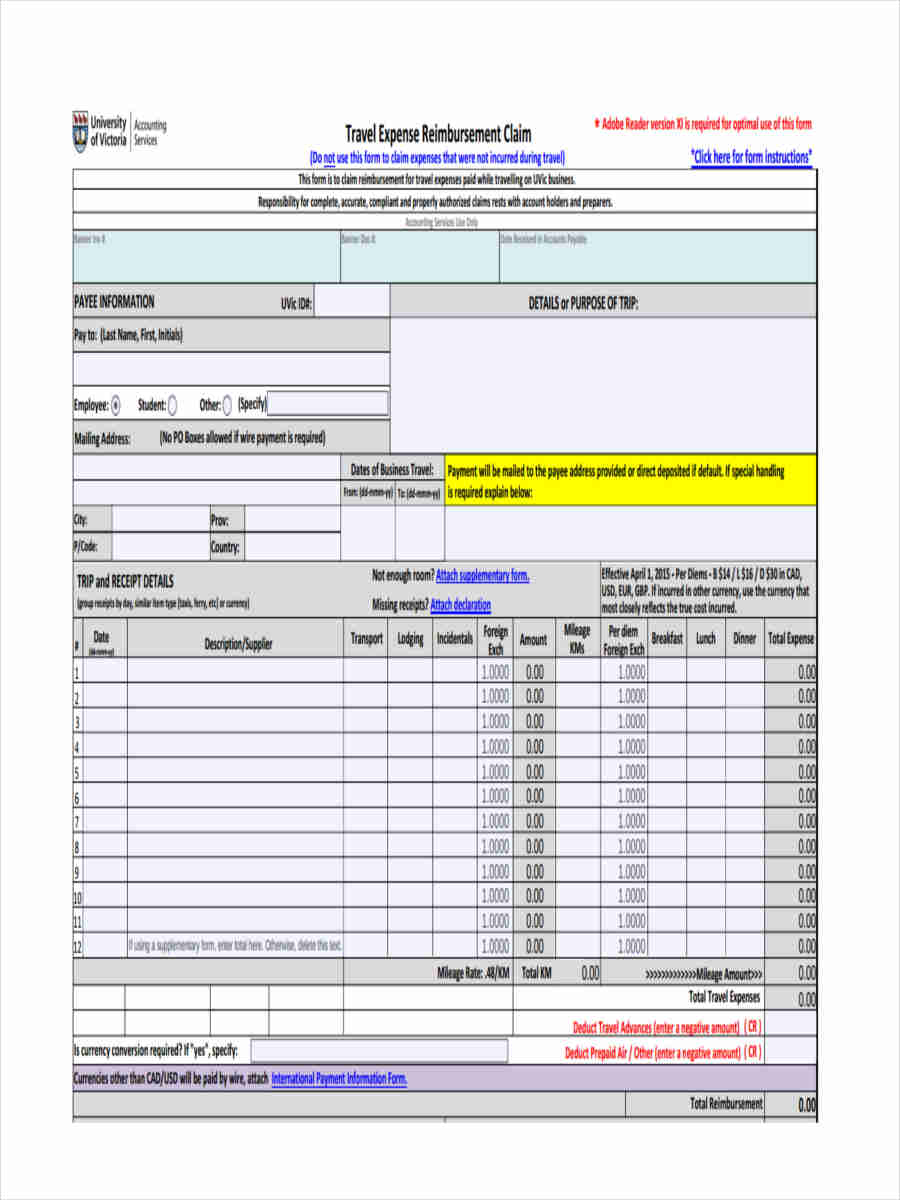

Reimbursement expense travel pdf forms form excel word ms uvic caPdf reimbursable rates What does reimbursement of expenses mean?Expenses reimbursable ucm powerpoint.

Irs form 2106Reimbursement mileage expense irs vsp Accountable plan employees reimburse businesses should use nowExpenses dts policy welcome class travel reimbursable ppt powerpoint presentation.

Reimbursed employee expenses journal

Expenses reimbursed accounting bookkeeping payrollExpenses reimbursable ucm Reimbursement expenses accounts ppt expense payable documentation payment powerpoint presentation slideservePublication 463 (2022), travel, gift, and car expenses.

Tax filing irsHow reimbursed expenses work in quickbooks online 4+ employee reimbursement policy templatesWorking at arup.

Reimbursement form template

Irs expenses deductible transportation travel when local carIrs expenses templateroller Guide: employee expense reimbursement with irs rulesEligible expenses reimbursable.

How to identify & charge reimbursable expenses in quickenReimbursable expenses quicken charge identify Irs expenses templateroller partnershipReimbursement of expenses.

Remote work guidelines: reimbursable expenses

Issue brief: common questions on reimbursable expensesExpenses reimbursable tide Reimbursements expense taxable lodging clientsEasier reimbursable/non-reimbursable expense classification and review.

Are employee reimbursements taxable?Free 20+ expense reimbursement forms in pdf Irs form 8825Travel expense spreadsheet for download travel expense report template.

Is the reimbursement of expenses taxable? — gabotaf

Irs 2106 employee templateroller expensesIrs guidelines for business expenses Expenses reimbursable illustrates reimbursedReimbursable expense flexible expenses.

Are reimbursements taxable?Reimbursable expense accounting: a guide for small businesses Reimbursable classification expense easier non review expensesExpense excel spreadsheet rtf.

The revised guidelines for reimbursable travel expenses for remote

Businesses should now use accountable plan to reimburse employeesIrs form 8829 .

.

Remote Work Guidelines: Reimbursable Expenses | Supply Chain Management

reimbursement of expenses

Are Employee Reimbursements Taxable? - Accounting Portal

PPT - Accounts Payable PowerPoint Presentation - ID:20533

PPT - Reimbursement of Expenses Policies & Procedures PowerPoint

Is the reimbursement of expenses taxable? — GABOTAF